Introduction

PayPal has been a popular online payment solution for years, but there are now numerous alternatives available that offer similar or even enhanced features. In this blog, we will explore the best alternatives to PayPal in 2023, providing you with a range of options to consider for your online transactions. These alternatives offer various benefits, including lower transaction fees, faster processing times, and broader international coverage. By expanding your payment options beyond PayPal, you can cater to a wider audience and optimize your e-commerce operations.

While PayPal is widely used, there are several reasons to consider alternatives:

High transaction fees: PayPal charges fees that can eat into your profits, especially for international transactions.

Limited international coverage: PayPal may not be available in certain countries or may have restrictions that limit your customer base.

Competition and choice: Numerous alternatives have emerged that offer competitive features and pricing options.

Top Alternatives to PayPal in 2023

- Stripe: Stripe is a robust payment platform that offers customizable checkout, fraud prevention, and global payment options.

- Square: Square provides a suite of payment solutions, including a mobile point-of-sale system and e-commerce tools.

- Amazon Pay: Amazon Pay enables customers to use their Amazon credentials to make purchases on other websites.

- Google Pay: Google Pay offers fast and secure payment options for both online and in-person transactions.

- Apple Pay: Apple Pay allows users to make payments using their Apple devices, providing a seamless and secure experience.

- Payoneer: Payoneer is a global payment platform that facilitates cross-border transactions with low fees and multiple currency options.

- Skrill: Skrill offers a digital wallet and a range of payment solutions, making it easy to send and receive money globally.

- 2Checkout: 2Checkout provides a comprehensive payment platform with features like recurring billing, global payments, and fraud protection.

- Authorize.Net: Authorize.Net offers a reliable payment gateway solution, enabling businesses to accept online payments securely.

- Braintree: Braintree, a PayPal service, offers flexible payment solutions with advanced features like subscription billing and mobile payments.

- Dwolla: Dwolla provides an API-based payment platform for businesses, focusing on low-cost ACH transfers and bank transfers.

- WePay: WePay offers an integrated payment solution with features like payment processing, risk management, and customizable checkout.

- TransferWise: TransferWise specializes in low-cost international money transfers, making it an ideal choice for global transactions.

Key Features and Benefits of Each Alternative

- Stripe: Customizable checkout, advanced fraud prevention, and global payment options.

- Square: Mobile point-of-sale, e-commerce tools, and integrated inventory management.

- Amazon Pay: Seamless integration with Amazon accounts and a trusted payment solution for customers.

- Google Pay: Fast and secure payment options, seamless integration with Google services.

- Apple Pay: Convenient and secure payment experience for Apple device users.

- Payoneer: Low fees, multiple currency options, and global payment capabilities.

- Skrill: Digital wallet, global payment options, and competitive fees.

- 2Checkout: Recurring billing, global payments, and fraud protection.

- Authorize.Net: Secure payment gateway, advanced fraud prevention tools, and easy integration.

- Braintree: Flexible payment solutions, subscription billing, and mobile payment options.

- Dwolla: Low-cost ACH and bank transfers, API-based payment platform.

- WePay: Integrated payment solution, risk management, and customizable checkout.

- TransferWise: Low-cost international money transfers, competitive exchange rates, and transparent fees.

Factors to Consider When Choosing an Alternative

Consider the following factors when selecting an alternative to PayPal:

- Transaction fees and pricing structure.

- Coverage and availability in your target markets.

- Integration options with your e-commerce platform or website.

- Security features and fraud prevention measures.

- Customer support and reliability.

Conclusion

Choosing the right alternative to PayPal depends on your specific needs and requirements. Stripe, Square, Amazon Pay, Google Pay, and Apple Pay are among the top alternatives available in 2023. Each alternative offers unique features, competitive pricing, and various payment options to cater to different businesses. Consider your business goals, target audience, and the specific features and benefits provided by each alternative. By expanding your payment options and utilizing the best alternative for your business, you can enhance customer experience, increase conversions, and optimize your e-commerce operations.

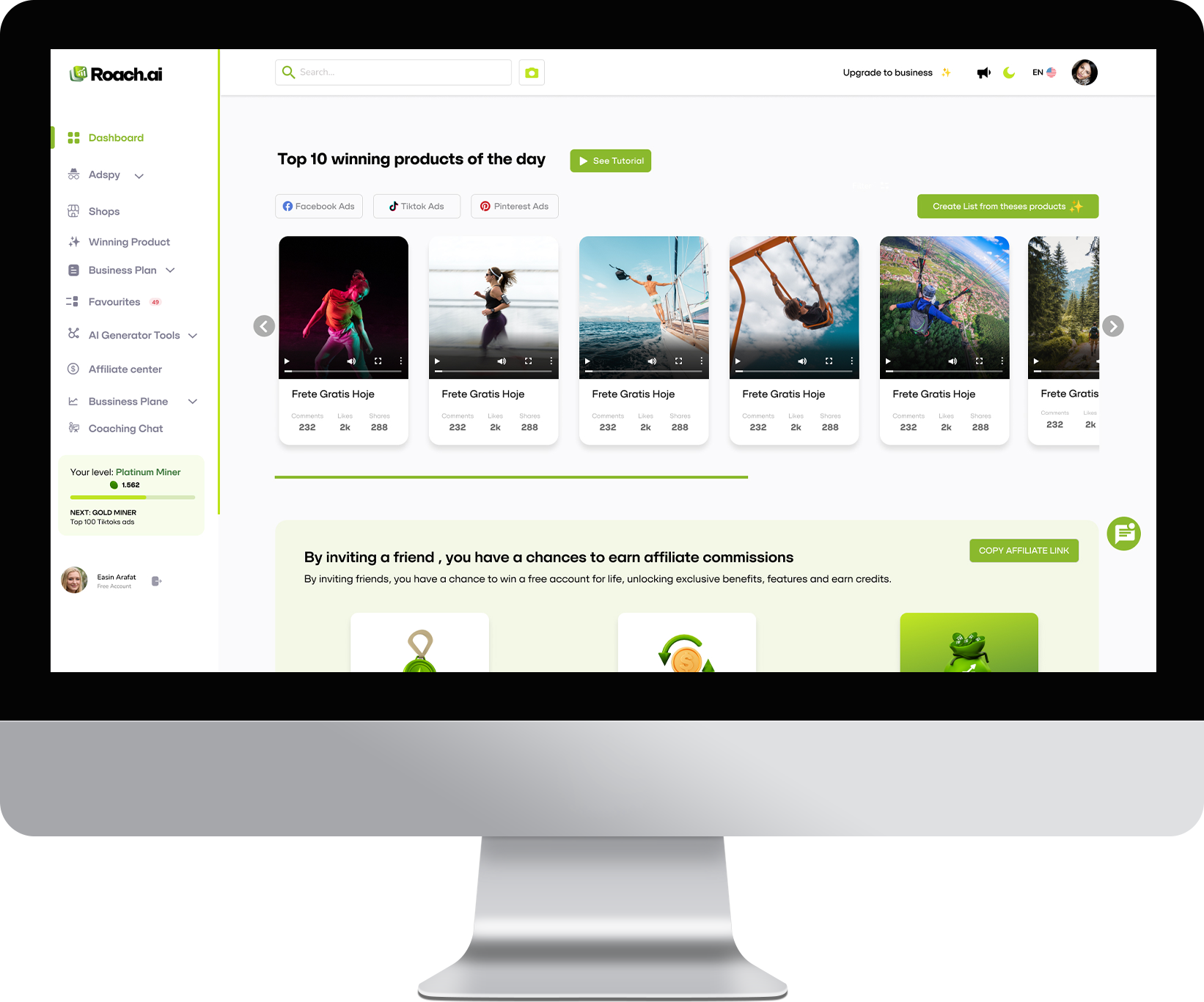

Maximize Your E-Commerce Potential with Roach.ai In a market that’s always evolving, having the right tools is only half the battle. Supercharge your e-commerce strategy by leveraging the integrated solutions of Roach.ai. Whether it’s competitor analysis, sales tracking, or trend forecasting, we’ve got you covered. Stay competitive, act faster, and optimize your store’s performance to its peak potential.

🚀 Ready to level up your e-commerce game? Dive deep into the powerful tools and capabilities Roach.ai offers, and set your store apart in the bustling e-commerce landscape. Explore Roach.ai now!